- BeerIntel

- Posts

- New Market Entrant “Stutter Step”

New Market Entrant “Stutter Step”

How U.S.-First Trade Policy is Affecting the Beer Industry

Executive Summary

While recent U.S. trade policy has emphasized domestic industry protection the effects on the U.S. beer market have not resulted in the exclusion of new products from foreign brands. Instead, BeerIntel’s latest analysis reveals a shift in timing, not volume, for new import entries. Despite external uncertainty, global brewers continue to view the U.S. as a strategically critical growth market.

Key Findings from BeerIntel Market Data

1. Structural Marginality of Imports Remains Unchanged

Foreign labels have historically accounted for a small share of new beer label applications in the U.S. This structural dynamic remains intact, despite shifts in macroeconomic conditions.

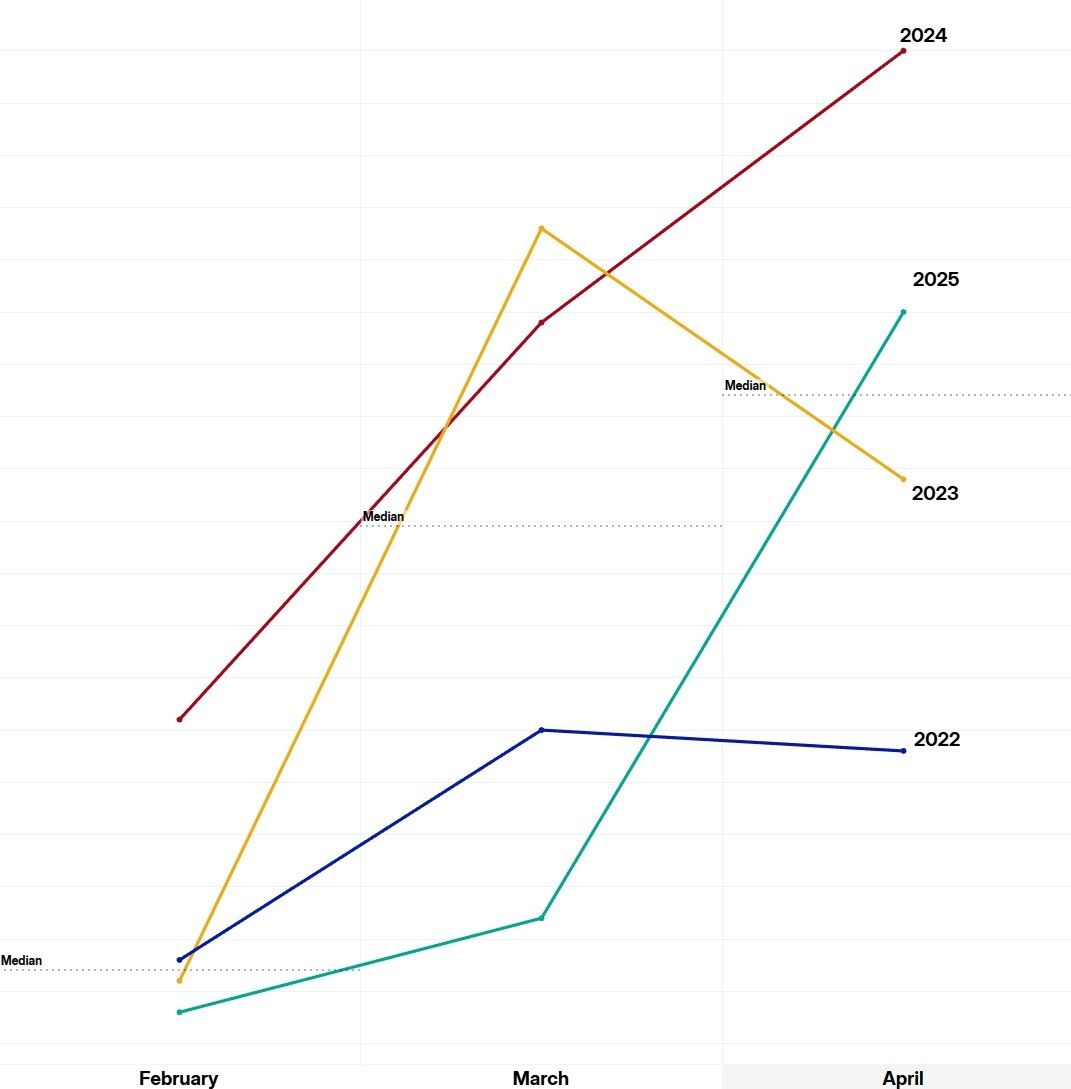

Domestic vs imported beer new label applications (Jan 2021-Apr 2025). BeerIntel

2. Import Behavior Mirrors Domestic Seasonality

This consistency signals alignment with U.S. distributor and retailer planning cycles, rather than independent strategic behavior.

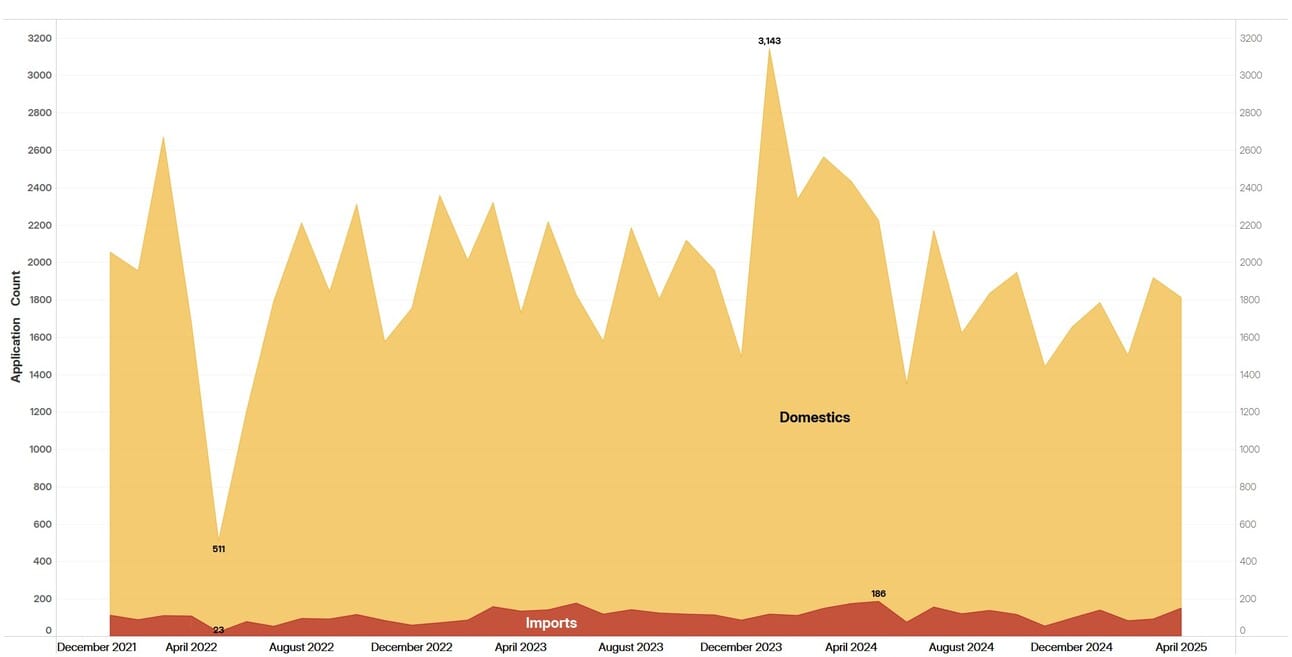

SPLIT AXIS (to show symmetry in trend) Domestic vs imported beer new label applications (Jan 2021-Apr 2025). BeerIntel

3. Tariffs Have Not Depressed Absolute Filing Volumes

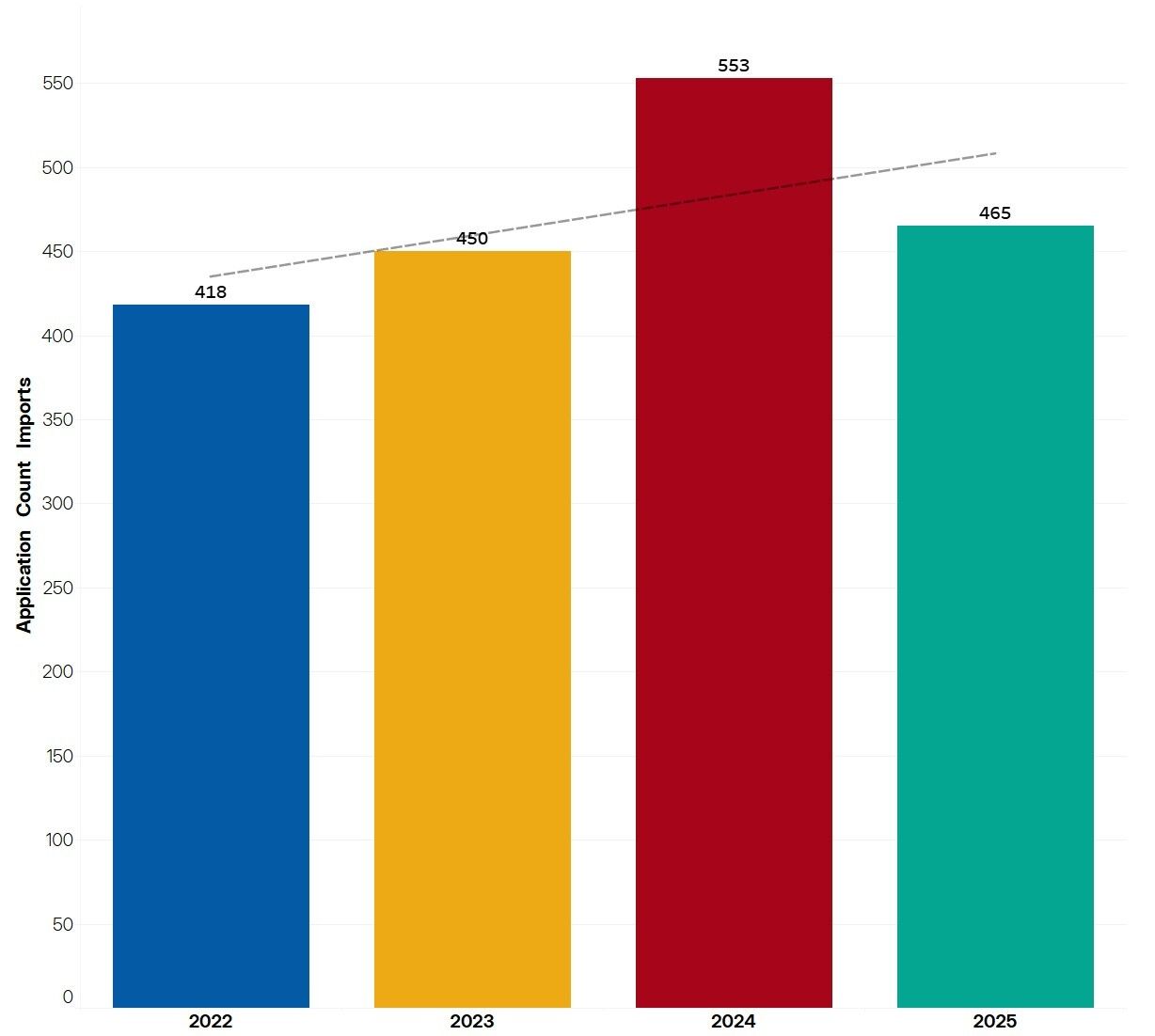

Label applications for foreign brands in the January-April 2025 period, while down slightly from 2024 highs, remain above 2022 and 2023 levels. The filing volume suggests sustained market confidence and long-term commitment to U.S. entry despite policy headwinds.

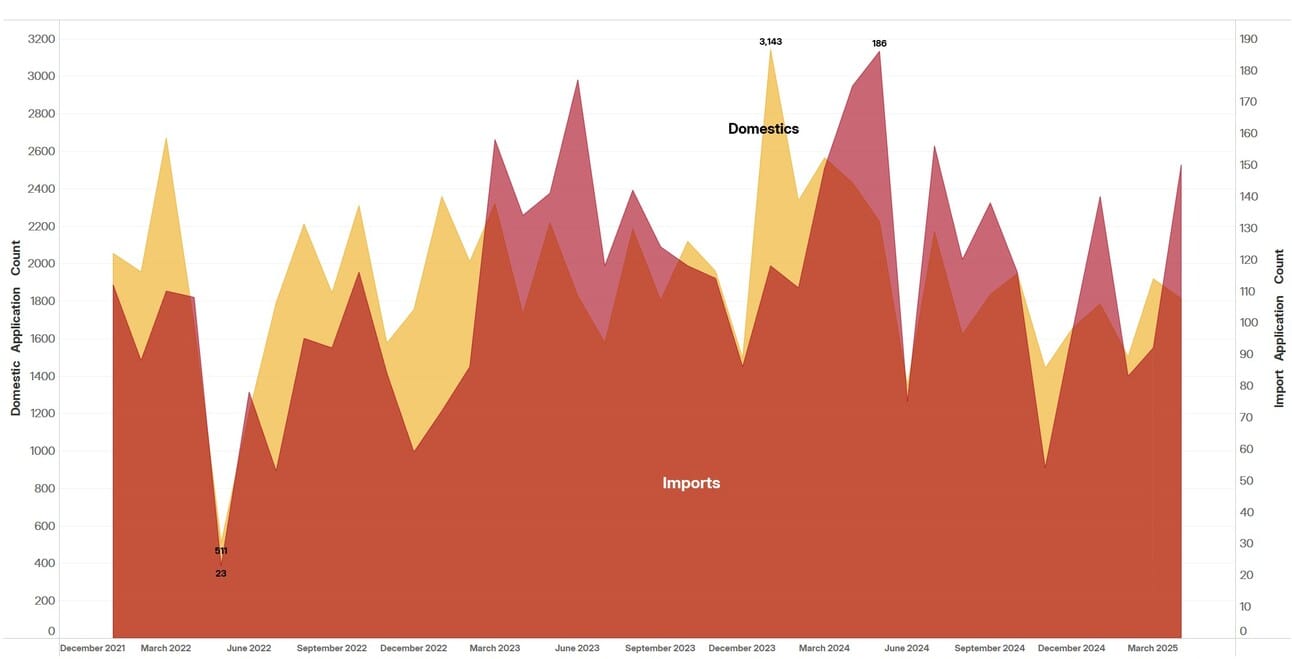

Combined domestic and imported beer applications (Jan-Apr). BeerIntel

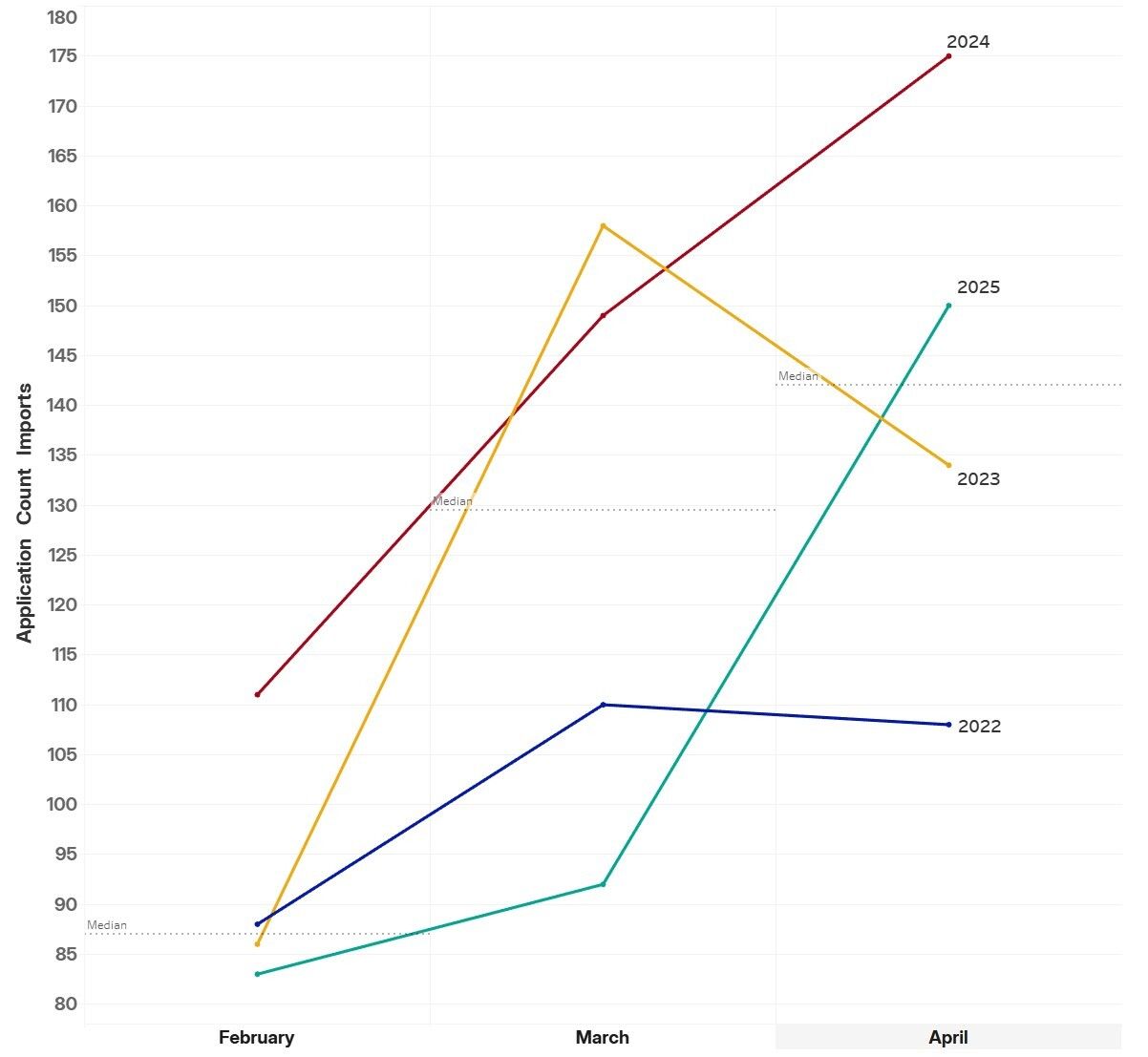

4. One-Month Lag Points to Temporary Hesitation, Not Structural Exit

The expected February to March rebound in label activity occurred with a four-week delay, likely due to near-term uncertainty surrounding trade enforcement and cost forecasts. However, this lag was followed by a clear resumption in activity, supporting the hypothesis of a tactical pause, not a strategic retreat.

We are seeing a market stutter step from importers; they clearly paused their efforts to enter the U.S. market but only momentarily. Their renewed resolve shows a continued interest in the market.

Imported beer submissions have shifted later in the year post tariff. BeerIntel

Strategic Interpretation: A Market “Stutter Step”

The data reflects what we term a “market stutter step”- a brief, tariff-induced hesitation from foreign entrants, followed by a return to trend. This behavior is indicative of a rational recalibration rather than systemic withdrawal.

Foreign brewers are adopting a wait-and-see approach, delaying market entry by weeks-not quarters-before moving forward. This behavior underscores the importance of the U.S. market in their global portfolio strategies.

Implications for Industry Stakeholders

Stakeholder | Strategic Action |

Domestic Brewer | Consider capitalizing on import timing delays to strengthen shelf space positioning. |

Distributors | Prepare for a normalization of foreign label entries and possible crowding in retail channels; short term product mix flexibility will be key. |

Retailers | Recognize that policy-induced uncertainty causes temporary market dislocations, but does not meaningfully alter long-term foreign participation. |

Outlook: Transitory Disruption, Not Structural Change

As of April 2025, BeerIntel’s tracking suggests that the impact of tariff-related policy uncertainty on the beer market may be short lived. Foreign brands remain engaged and agile. Unless regulatory measures result in substantial cost barriers, the current delay pattern is unlikely to develop into a long-term market contraction.

We will continue to monitor monthly label application trends to assess whether this resilience holds.

To learn more about BeerIntel’s intelligence database write to John Gordon at:

Reply