- BeerIntel

- Posts

- U.S. Beer Import Landscape: Stability Amid Strategic Reprioritizations

U.S. Beer Import Landscape: Stability Amid Strategic Reprioritizations

BeerIntel Quarterly Import Brief – Q1 2025

Executive Summary

Despite a volatile global economic backdrop and ongoing regulatory shifts, foreign brewer participation in the U.S. beer market has remained structurally stable. Analysis of BeerIntel import data from 2022 through Q1 2025 reveals a consistent geographic distribution of imports, a persistent core of dominant trade partners, and a reshuffling within the top-tier cohort. The data signals that the U.S. remains a strategically critical market for a select group of foreign producers, while participation by peripheral players remains sporadic.

Key Findings

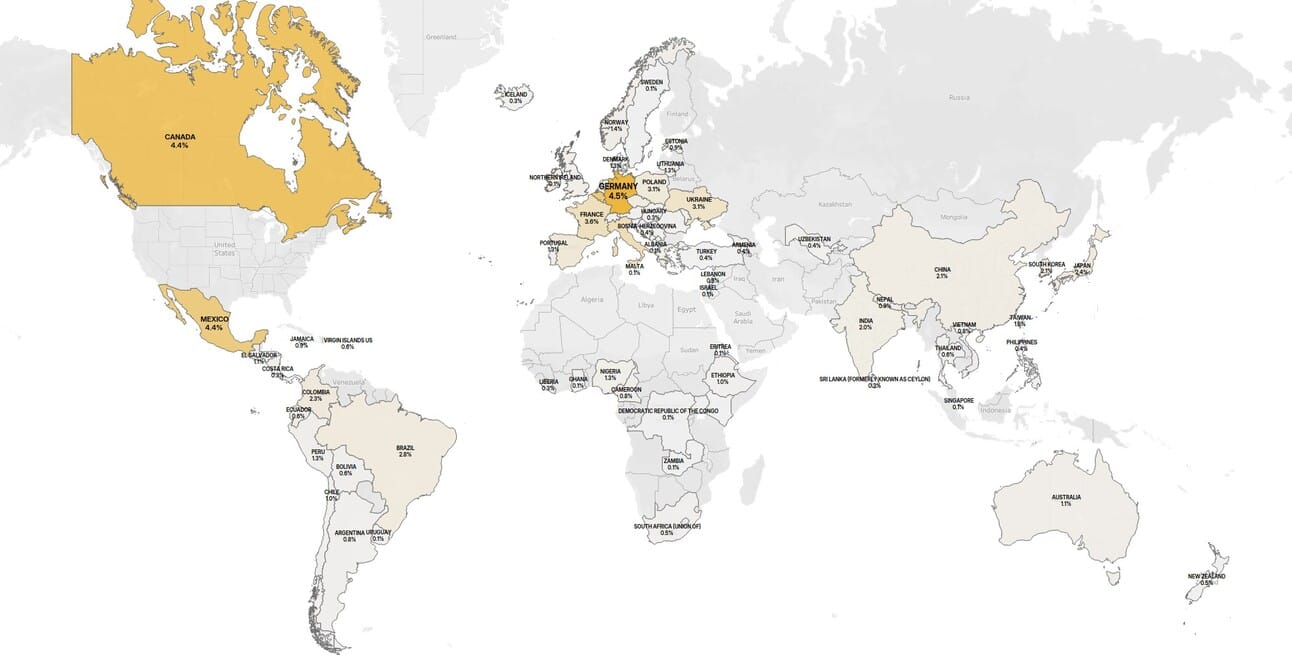

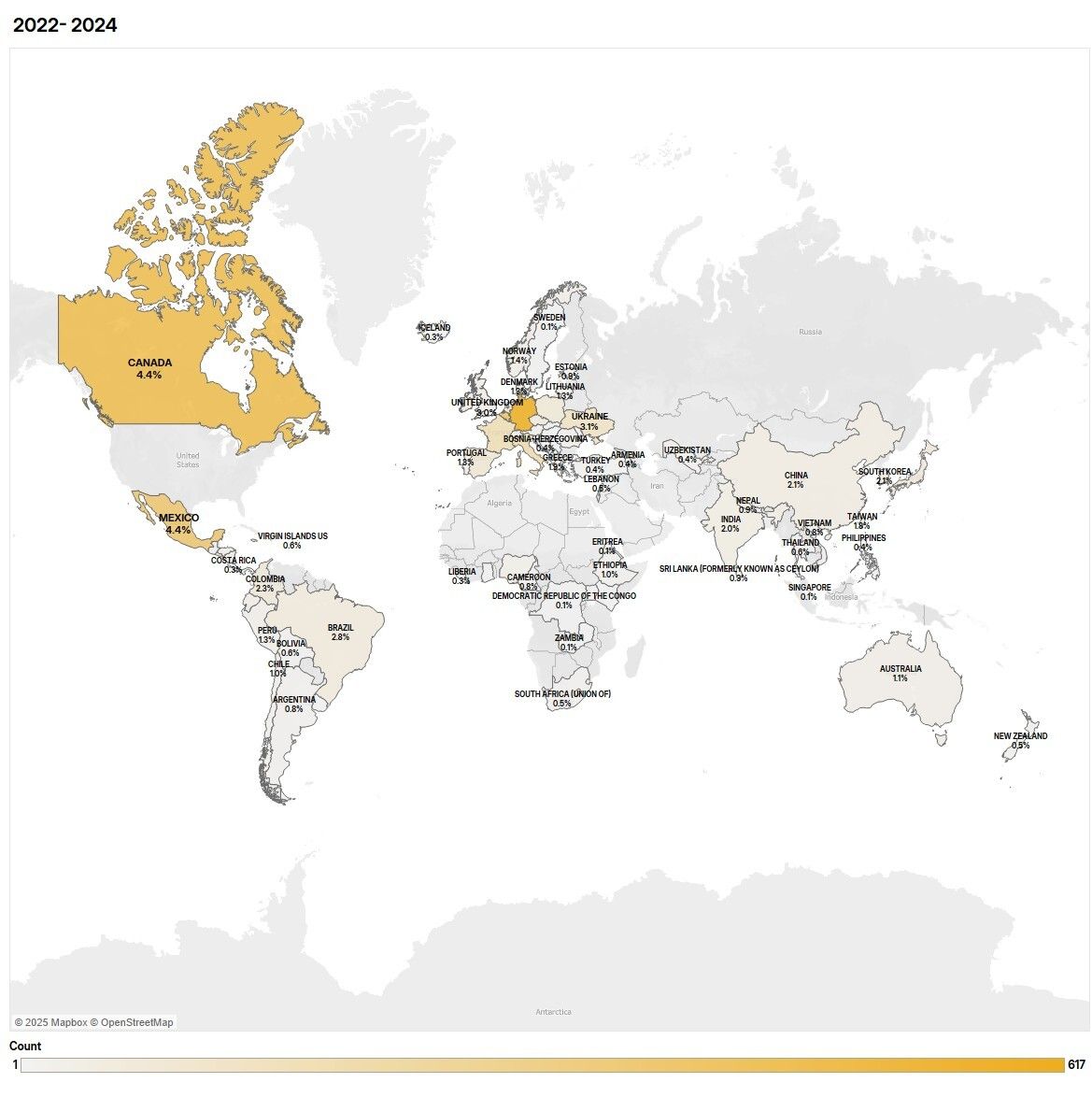

1. Geographic Breadth Remains Consistent

All continents—excluding Antarctica—continue to be represented in U.S. imports through Q1 2025.

The Nordic countries have become absent so far this year, breaking a previous pattern of consistent activity.

Russia remains entirely excluded due to U.S. embargo policies implemented in 2022, not necessarily from a lack of commercial intent.

Geographic Reach of U.S. Import Market 2022-2024 BeerIntel

Geographic Breadth Remains Widespread in Q1 of 2025 BeerIntel

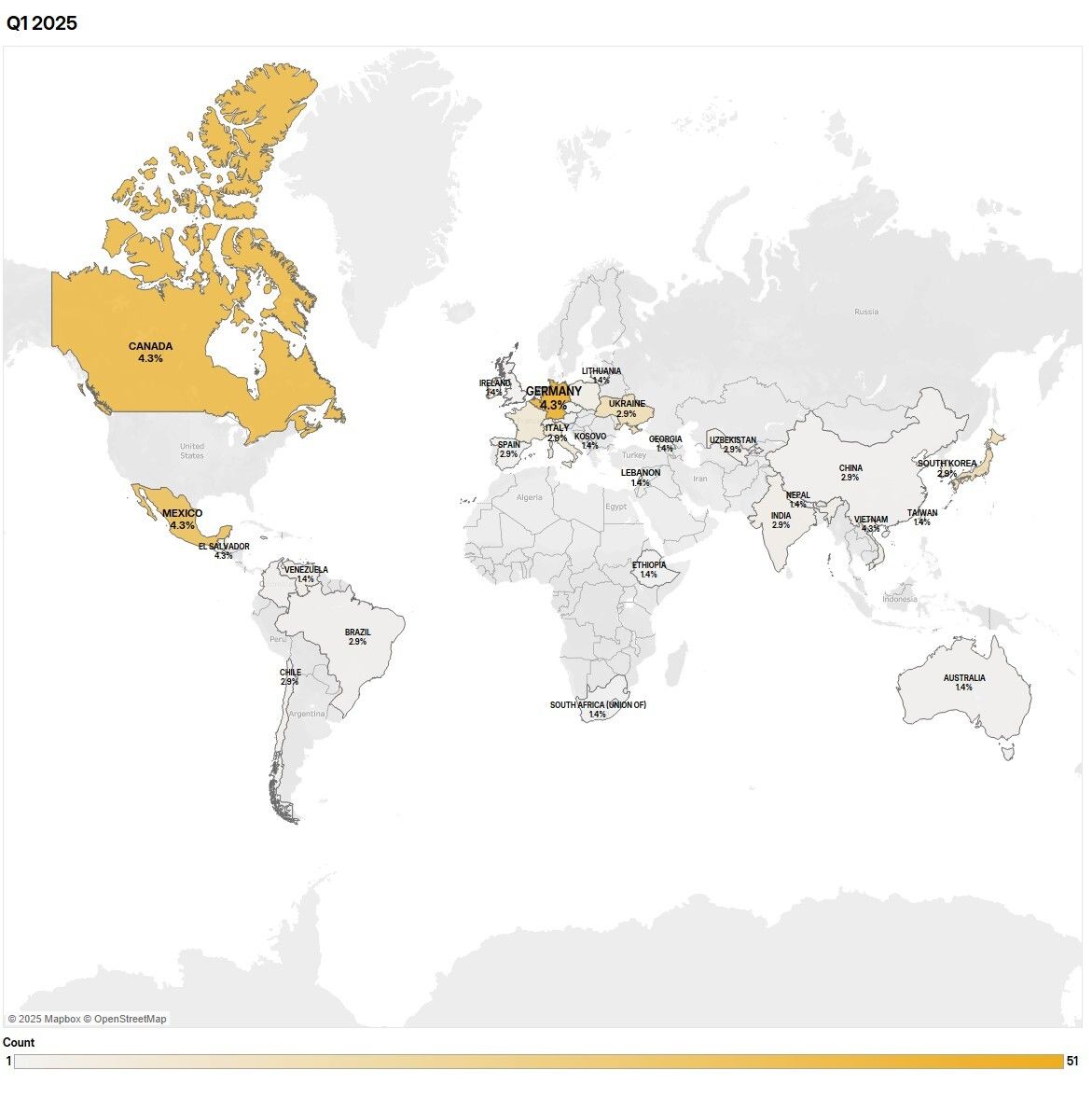

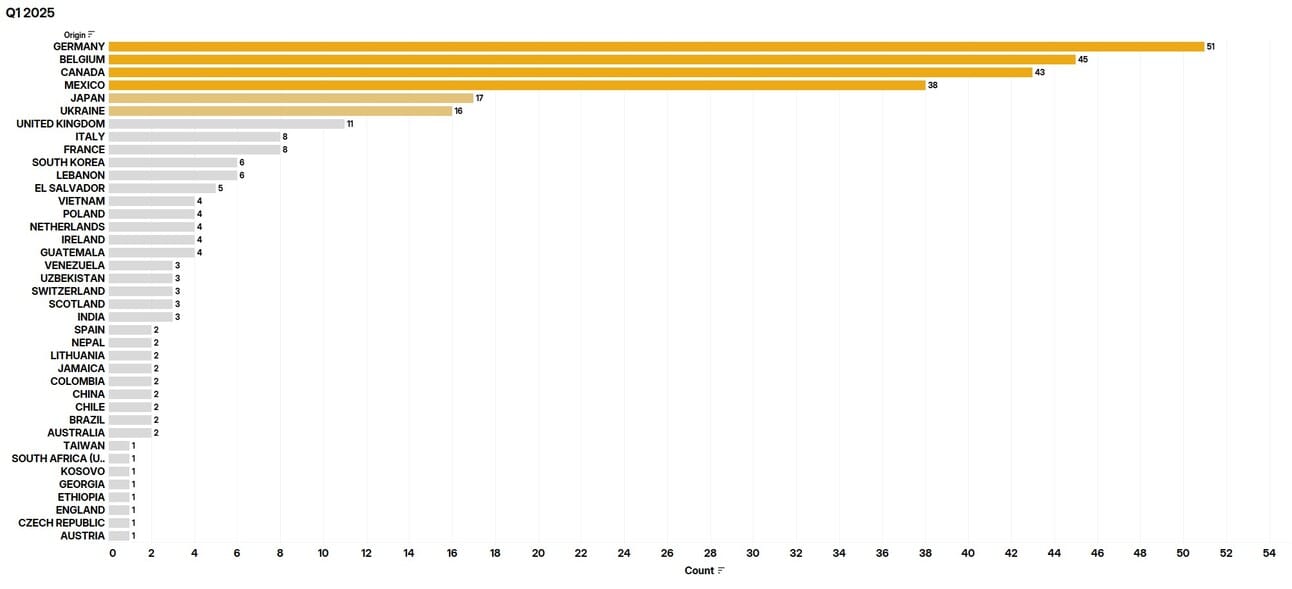

2. Stable Three-Tiered Market Structure

Tier 1: Germany, Belgium, Canada, and Mexico label applications dominate both in volume and year-over-year consistency.

Tier 2: Italy, France, Ukraine, and the U.K. show moderate, recurring presence.

Tier 3: Composed of countries with irregular or opportunistic participation, suggesting limited strategic investment.

Stable Three-Tiered Market Structure Emerged Over 2022-2024 *list of countries truncated for space BeerIntel

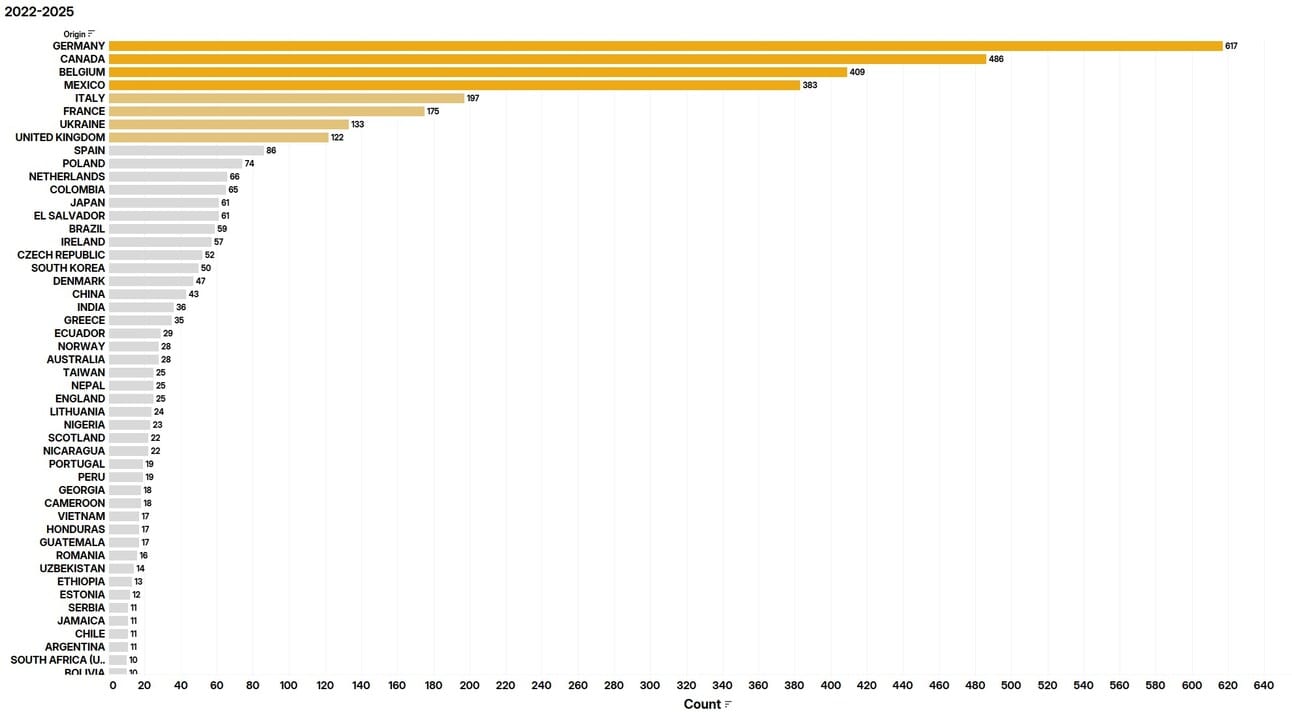

3. Recent Shifts in Leadership

Q1 2025 data shows Belgium overtaking Canada, by a very small margin, to become the second-largest importer represented in the data.

Germany and Mexico maintain the top and fourth positions, respectively.

Early Data Shows National Repositioning BeerIntel

We Expect to See More Nations Enter the Market as the Year Progresses BeerIntel

4. Regulatory Lag Offers Strategic Signal

The U.S. label approval and importation process introduces a significant lag (often several months), offering predictive insight for stakeholders tracking future availability and shifts in foreign brewer focus.

Strategic Interpretation

The consistency in foreign interest—despite macro disruptions—underscores the structural importance of the U.S. market in global beer portfolio strategies. Countries with strong brand equities and established distribution infrastructure continue to deepen their foothold. The strategic repositioning of Belgium suggests an active recalibration in export priorities.

Concurrently, the absence of new entrants or diversification from previously active countries (e.g., Nordics) highlights the high barrier to entry, both regulatory and competitive. This dynamic reinforces the “fortress” nature of the U.S. beer market, favoring established players with the operational capacity to navigate compliance and market fragmentation.

Implications for Industry Stakeholders

Domestic Brewers

Competitive Vigilance: The sustained foreign presence—particularly from European brewers with premium positioning—intensifies competition for shelf space and brand equity in key urban markets.

Differentiation Imperative: As import portfolios remain stable, local brands must innovate beyond provenance and price, leaning into craft, community, or category expansion (e.g., RTDs, no/low-alcohol).

Distributors

Portfolio Rationalization: Distributors should prioritize relationships with Tier 1 importers who demonstrate year-over-year consistency and strategic commitment.

Trend Forecasting: Use import filing and label registration trends to anticipate shifts in inventory and channel demand six months ahead.

Retailers

Merchandising Precision: High-velocity foreign SKUs remain consistent—suggesting minimal risk in continuing to allocate space to top-tier imports.

Category Management: Evaluate whether lower-tier imports merit continued rotation, or if local craft offerings offer stronger ROI per square foot.

Outlook: 2025 and Beyond

The U.S. beer import landscape shows little deviation in geographic diversity or core participation, suggesting structural maturity. We anticipate:

Continued concentration around the top four importing countries.

Incremental reshuffling within Tier 1, especially among European players seeking margin protection through premium offerings.

Limited expansion in the number of active importing nations due to regulatory friction, and consolidation of distributor networks.

Overall, stakeholders should expect stability—not stagnation—in import activity, with subtle signals from Q1 2025 data pointing to strategic recalibration rather than market retraction.

To learn more about BeerIntel’s intelligence database write to John Gordon at:

Reply