- BeerIntel

- Posts

- Navigating Saturation

Navigating Saturation

Strategic Imperatives for Brewers, Distributors, and Retailers

When label application volumes rise it is an indicator that the beer industry is entering a new phase marked by increasing market saturation. These conditions are intensifying competitive pressures and elevating the cost of consumer acquisition and retention. The result: a landscape defined by accelerated brand rivalry and shrinking margins for those without clear strategic focus.

This briefing outlines critical strategic imperatives for industry participants seeking to remain competitive in increasingly saturated marketplaces.

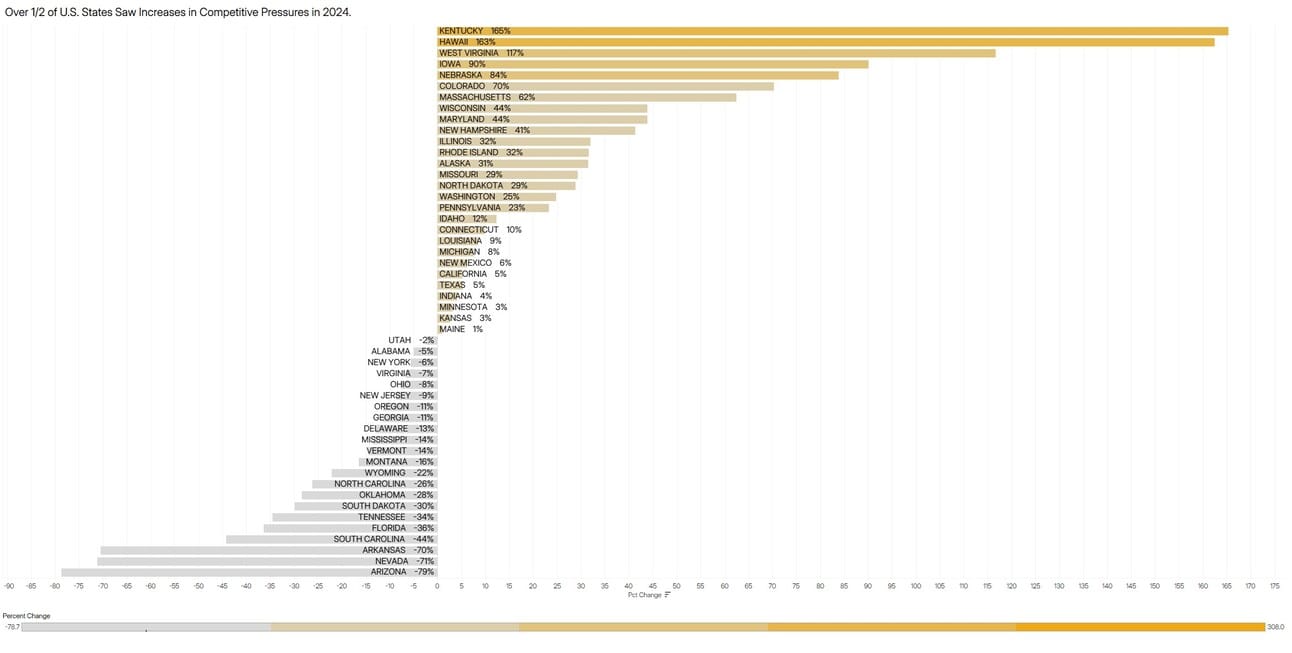

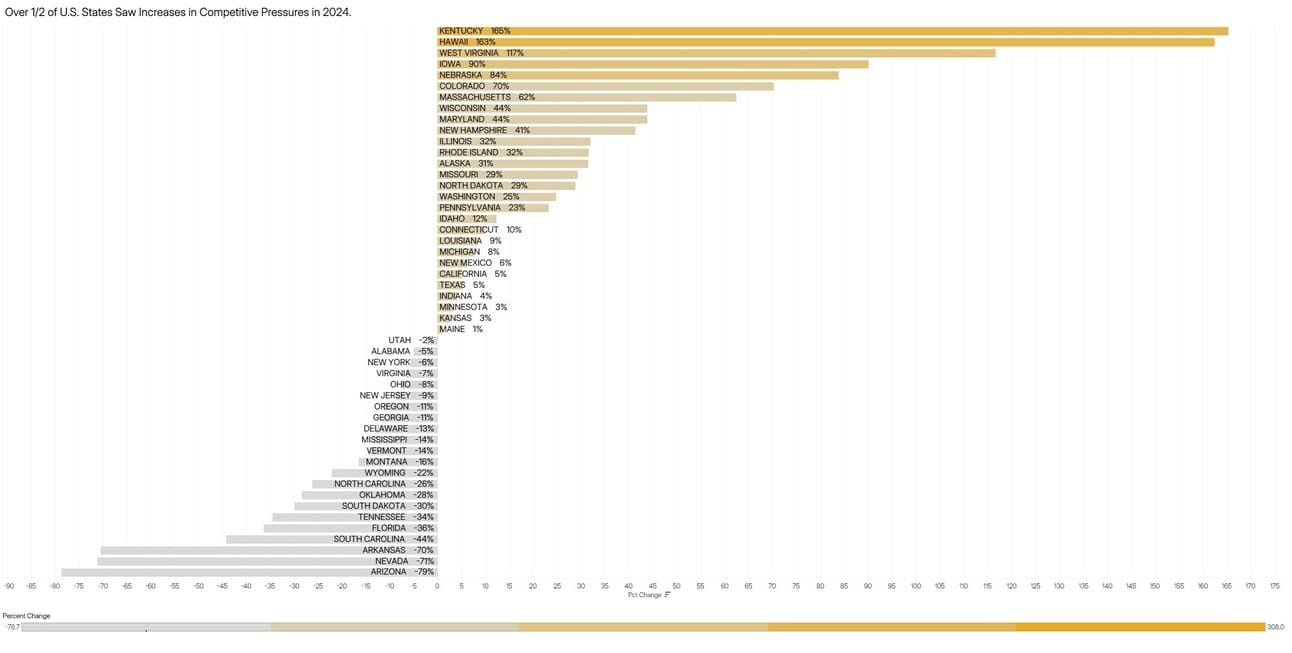

When measured by Percentage of Change between 2023 & 2024 Over Half of All U.S. States Saw Increases in Label Applications.

1. Brewers: From Differentiation to Dominance

In saturated environments, success hinges on the ability to identify and dominate emerging micro-segments before they mature.

Segmentation Intelligence: Leveraging granular market data to identify white-space opportunities is no longer optional—it's foundational.

Capital Allocation: Sustained visibility requires ongoing investment. Whether through advertising, seasonal releases, or targeted innovation, the cost of inaction is erosion of relevance.

Price Leadership: Only after achieving segment dominance can a brand influence price architecture. Until then, it must conform to prevailing market pricing dynamics.

Strategic Priority: Shift from reactive participation to proactive segment targeting backed by sustained brand investment.

2. Distributors: Scaling in a Saturated Environment

Distributors face multiple pressures: maintaining margin while maximizing turns and managing SKU proliferation.

Operational Efficiency: In markets with high SKU churn, streamlined, low-friction product onboarding processes are critical.

Partner Selectivity: Strategic focus requires relationships with brands that demonstrate both innovation capacity and financial commitment.

Data Infrastructure: Investment in interoperable data systems enables real-time alignment across suppliers and retailers—critical for agility and scale.

Strategic Priority: Build and optimize an integrated data backbone that enables rapid decision-making and cross-channel coordination.

3. Off-Premise Retailers: Maximizing Velocity

Retailers must operate with a balance of scale economics and product agility to adapt to rapid shifts in consumer behavior.

Consumer Insight: Early detection of consumption pattern shifts enables inventory optimization.

SKU Rationalization: Willingness to de-list low-performing products in favor of higher-velocity items is a core management lever.

Strategic Priority: Treat shelf space as a dynamic asset—continuously reallocate based on real-time product performance and industry trend data.

4. On-Premise Retailers: Deepening Brand Equity

Unlike off-premise, on-premise retailers often offer fewer SKUs with higher margins. This makes brand alignment and loyalty even more critical.

Curated Selection: Unless brand diversity is a core element of the customer value proposition, frequent rotation dilutes brand equity and confuses positioning.

Loyalty Optimization: Consumer familiarity and repeat purchase behavior drive margin sustainability in this channel.

Strategic Priority: Optimize brand curation for depth, not breadth—build loyalty through alignment with the venue’s core identity.

The Path Forward

When the beer industry shifts toward deeper saturation, stakeholders must evolve accordingly. Success will favor those who:

Use data as a strategic asset

Align investment with segment potential

Build operational systems capable of responding to volatility

The future of beer is not just competitive—it is adaptive. The winners will be those with operations purpose built for continual change.

To explore how BeerIntel’s proprietary data platform can support your strategy, contact:

[email protected]

Reply